Investment proposition

CEREIT offers the opportunity to invest in attractive European freehold commercial real estate with a trusted Manager and experienced local Property Manager.

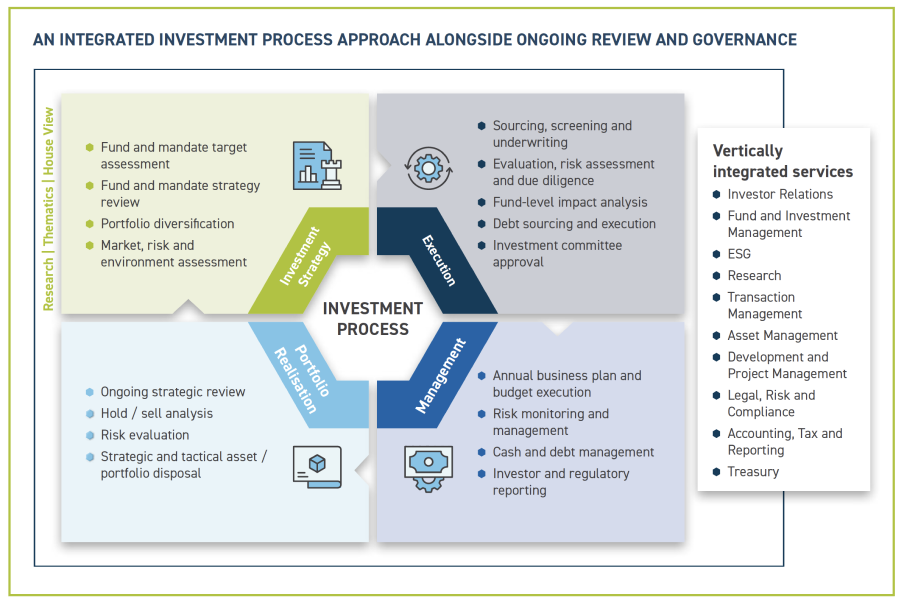

Investment strategy

CEREIT has a principal mandate to invest, directly or indirectly, in income-producing commercial real estate assets across Europe with a minimum portfolio weighting of at least 75% to Western Europe and at least 75% to the light industrial / logistics and office sectors. CEREIT currently targets maintaining majority investment weighting to the logistics / light industrial sector while also investing in core office assets in gateway cities

The Manager aims to achieve CEREIT’s objectives through executing on the following key strategies:

Active asset management and asset rejuvenation

Capital recycling, sustainable developments and AEIs

Responsible capital management

High ESG standards and disclosures